How to Mitigate the Impacts of Occupational Disability.

Entrepreneurs face the risk of becoming unable to work due to illness or accidents. These impacts can be minimized through insurance and a living will.

Compensating for the Loss of Income.

When you fall ill or become disabled, you may become incapable of working, either partially or entirely, temporarily or permanently.

Insurance ensures that you still have income when you are incapacitated for work. This insurance often has a waiting period, for example, one month. After this period, the insurance begins to make payments. For instance, if you have the flu for a week, you won't receive compensation.

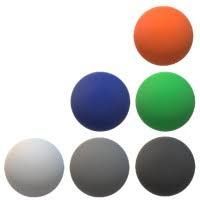

There are various ways to get insured. You can take out disability insurance (AOV) with a private insurer, an interest or professional organization. Additionally, you can get insurance from the Employee Insurance Agency (UWV). You can also opt for a community fund (broodfonds) or a collective insurance (crowdsurance).

Insurance Options.

Read more about the different options for disability insurance in this article.

Not all entrepreneurs opt for disability insurance due to the costs involved. The average monthly premium for disability insurance ranges from 200 to 300 euros. The height of the premium depends on the type of work, age, insured amount, among other factors. For example, a construction worker faces more risks than an accountant and pays more for insurance.

Limiting Legal Impacts.

ABy drafting a living will, you can limit the legal impacts of occupational disability. This ensures that the person you have chosen (proxy) makes decisions for your business when you cannot, for example, due to brain damage.

In the living will, you can decide in advance who will order new stock on your behalf, pay salaries to your employees, and file the value-added tax (VAT) return. If you don't, your colleagues may need to go to court to settle these matters, which often takes months. During this time, your company may come to a standstill, which can have significant consequences.

A living will typically consists of two parts: a power of attorney for financial matters and another for medical and personal matters. This will is drawn up in conjunction with a notary. If you have a private limited company (bv), you may not always be able to appoint a proxy for your business unless you own all the shares of the company.

Nothing Arranged.

If you haven't arranged anything and fall ill, there is a risk of having to use your own assets before being entitled to compensation. Even if your partner has an income, you often cannot claim compensation.

If you (like your partner) have no income and assets, you may be eligible for compensation, such as social assistance, IOAZ, or unemployment benefits. However, these compensations are subject to specific conditions.

If you don't have a living will and are no longer able to make decisions, someone else will need to take care of your affairs. Someone from your close circle, such as your partner or a colleague, can apply for this role to the guardianship judge. This judge will appoint a person as a guardian or tutor.

Adjusting the Registration at KVK.

When you become unable to work, it may be necessary to adjust the registration of your company in the Chamber of Commerce Business Register. As each situation is unique, it is recommended to contact the Chamber of Commerce.

Source:https://www.kvk.nl/wetten-en-regels/hoe-je-gevolgen-van-arbeidsongeschiktheid-beperkt/